Have you ever wondered if you get taxed on Only Fans? Well, I’ve got the answer for you! In this article, we’ll dive into the world of Only Fans and explore whether or not you need to pay taxes on your earnings. So, if you’re a content creator or simply curious about the financial side of this popular platform, keep on reading!

Only Fans has gained immense popularity as a platform for creators to share exclusive content with their subscribers. From fitness enthusiasts to artists and even celebrities, many individuals have found success and financial independence through this platform. However, with financial success comes the responsibility of taxes. So, do you get taxed on Only Fans? Let’s find out! We’ll explore the tax implications, regulations, and everything you need to know about managing your earnings on this platform. Let’s get started!

Do You Get Taxed on OnlyFans?

OnlyFans has gained significant popularity in recent years as a platform for content creators to monetize their work and connect with fans. However, with the rise in popularity comes questions about the tax implications for those earning income through OnlyFans. In this article, we will explore whether or not you get taxed on OnlyFans and provide some helpful information to guide you through the process.

Understanding Tax Obligations for OnlyFans Creators

When it comes to taxation, it’s important to note that laws and regulations can vary from country to country. Therefore, it is crucial to consult with a tax professional or accountant who is familiar with the tax laws in your specific jurisdiction. They will be able to provide personalized advice based on your individual circumstances.

In general, income earned through OnlyFans is considered taxable. This means that you are required to report your earnings and pay taxes on the income you generate from the platform. Whether you are a full-time content creator or a part-time hobbyist, any income earned should be reported to the tax authorities.

Income Reporting and Self-Employment Taxes

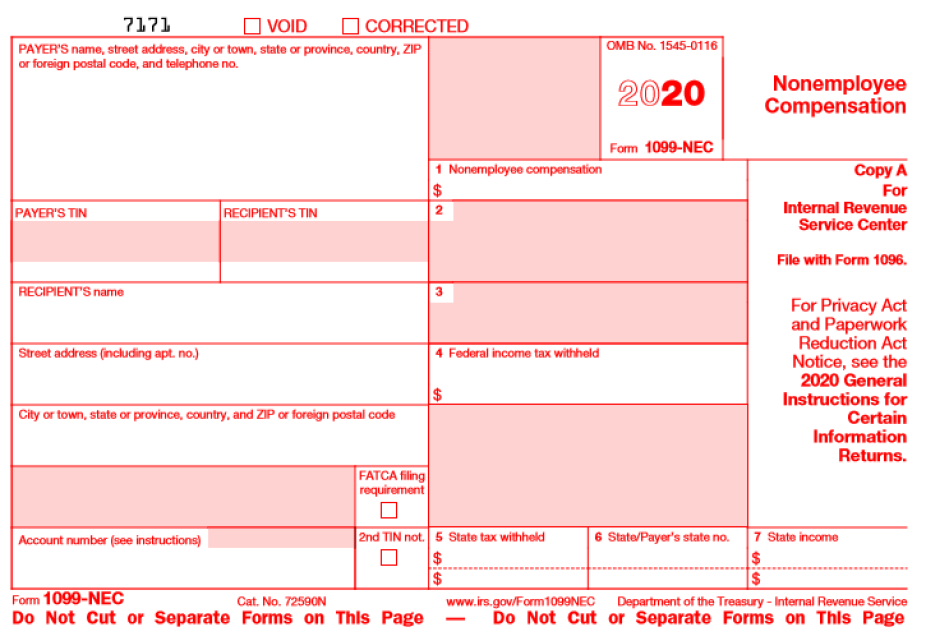

As an OnlyFans creator, you are essentially operating as a self-employed individual. This means that you are responsible for reporting your income and paying self-employment taxes. Self-employment taxes typically include both the employer and employee portions of Social Security and Medicare taxes.

It’s important to keep track of your earnings from OnlyFans throughout the year. This can be done by diligently documenting your income and expenses related to your content creation. By maintaining accurate records, you’ll be better prepared when it comes time to file your taxes.

If you are earning a substantial amount of income on OnlyFans, you may also be required to make estimated tax payments throughout the year. These payments are typically made on a quarterly basis and help ensure that you are meeting your tax obligations in a timely manner.

Deductible Expenses for OnlyFans Creators

One advantage of being a self-employed individual is the ability to deduct certain business expenses. As an OnlyFans creator, you may be eligible to deduct expenses related to your content creation. Some common deductible expenses for OnlyFans creators include:

1. Camera equipment and other necessary technology

2. Props and costumes used in your content

3. Internet and phone bills

4. Website hosting fees

5. Marketing and advertising costs

6. Professional development and training expenses

It’s important to note that deductible expenses must be directly related to your OnlyFans business. Additionally, it’s crucial to keep thorough records and receipts for all expenses claimed on your tax return.

Consulting with a Tax Professional

Navigating the tax obligations of being an OnlyFans creator can be complex, especially if you are unfamiliar with self-employment taxes. To ensure compliance and maximize your tax benefits, it’s highly recommended to consult with a tax professional or accountant who specializes in working with content creators.

A tax professional will be able to provide personalized advice tailored to your specific situation. They can help you understand your tax obligations, identify deductible expenses, and ensure that you are accurately reporting your income on your tax return. While it may require an additional investment, the guidance and peace of mind provided by a tax professional can be invaluable.

Conclusion

In summary, as an OnlyFans creator, you are likely to be subject to taxation on your earnings. It’s essential to consult with a tax professional or accountant who is familiar with the tax laws in your jurisdiction to ensure compliance and maximize your tax benefits. By keeping accurate records, reporting your income, and deducting eligible expenses, you can navigate the tax obligations of being an OnlyFans creator with confidence. Remember, each individual’s tax situation is unique, so seeking professional advice is crucial to ensure you meet your obligations.

Key Takeaways: Do You Get Taxed on Only Fans?

- Yes, you may have to pay taxes on your earnings from OnlyFans.

- The exact tax amount depends on your total income and local tax regulations.

- It’s important to keep track of your earnings and expenses for tax purposes.

- Consider consulting with a tax professional to ensure you meet your tax obligations.

- Remember to report your OnlyFans income accurately to avoid any legal issues.

Frequently Asked Questions

OnlyFans has gained popularity as a platform for content creators to share exclusive adult content with their subscribers. However, with the potential to earn income from these subscriptions, it’s important to understand the tax implications. Here are some common questions about taxation on OnlyFans:

1. Are earnings from OnlyFans taxable?

Yes, earnings from OnlyFans are taxable. Whether you are a content creator or a subscriber, the income you receive or pay on the platform may be subject to taxation. It is essential to report your earnings accurately and consult with a tax professional to ensure compliance with tax laws in your jurisdiction.

As a content creator, you need to keep track of your earnings and any associated expenses. You may be required to file self-employment taxes and report your income on Schedule C of your tax return. It’s advisable to consult with a tax professional to understand your specific obligations and deductions.

2. Is there a minimum threshold for reporting earnings on OnlyFans?

While tax laws can vary depending on your location, it’s important to note that there may not be a minimum threshold for reporting earnings on OnlyFans. Even if your earnings are below a certain amount, you may still need to report them. It’s always best to consult with a tax professional to understand your reporting requirements.

Remember, accurately reporting your income is crucial to avoid potential penalties or audits. Keep track of all your earnings, even if they seem insignificant, to stay compliant with tax regulations.

3. Can I deduct expenses related to my OnlyFans business?

As an OnlyFans content creator, you may be eligible to deduct certain business expenses. These expenses can include equipment, props, internet bills, marketing costs, and even a portion of your home office expenses if you use a designated space for your business.

However, it’s important to note that deductions must be directly related to your OnlyFans business and must be supported by proper documentation. Consult with a tax professional to determine what expenses are deductible and how to accurately report them on your tax return.

4. What if I receive payments from subscribers outside my country?

If you receive payments from subscribers outside your country, you may have additional tax considerations. International tax laws can be complex, and it’s advisable to seek guidance from a tax professional who is familiar with cross-border taxation.

Some countries have tax treaties in place to prevent double taxation, while others may require you to report and pay taxes on foreign income. To avoid any issues, consult with a tax professional who can provide guidance based on your specific circumstances.

5. Should I consult a tax professional for my OnlyFans earnings?

Given the unique nature of earning income from OnlyFans, it is highly recommended to consult with a tax professional. They can provide personalized advice based on your specific circumstances and help ensure you understand and comply with all relevant tax laws.

A tax professional can guide you through the process of reporting your earnings, help you identify deductible expenses, and assist with any international tax considerations if applicable. Their expertise can save you time, money, and potential headaches in the long run.

How I File My ONLYFANS TAXES!

Final Thoughts: Are You Taxed on Only Fans?

So, we’ve delved into the intriguing world of Only Fans and the question on everyone’s mind: “Do you get taxed on Only Fans?” After examining the available information, it’s clear that taxation on Only Fans income can vary depending on several factors. While I’m no tax expert, I can shed some light on this matter.

First and foremost, it’s crucial to note that tax laws differ from country to country, and even within different states or provinces. So, whether or not you get taxed on Only Fans earnings will largely depend on your location. In some areas, income generated from platforms like Only Fans is considered self-employment income and is subject to taxation. In other cases, it may be classified as miscellaneous income or even entertainment income. It’s essential to consult with a tax professional or research the specific tax laws in your jurisdiction to ensure you’re staying compliant and fulfilling your tax obligations.

Furthermore, the amount of money you earn on Only Fans can also impact your tax liability. If your earnings reach a certain threshold, you may be required to report and pay taxes on that income. Keep in mind that this includes both the money you receive directly from subscribers and any additional revenue from tips, paid content, or other sources.

In conclusion, while the topic of taxation on Only Fans income can be complex and varies depending on your location and earnings, it’s vital to stay informed and consult with a tax professional to ensure you’re meeting your obligations. Remember, tax laws can change, so it’s essential to stay up to date to avoid any unexpected surprises come tax season. Stay informed, stay compliant, and continue enjoying your journey on Only Fans!