Have you ever wondered if you have to pay taxes on OnlyFans? It’s a question that many creators on the platform have asked themselves. After all, OnlyFans has become a popular platform for individuals to share exclusive content and connect with their fans. But when it comes to taxes, things can get a little complicated. In this article, we’ll dive into the world of OnlyFans and explore whether or not you need to pay taxes on your earnings. So grab a cup of coffee and let’s get started!

When it comes to taxes, it’s always important to stay informed and make sure you’re following the rules. OnlyFans is no exception. While it may seem like a gray area, the truth is that if you earn money on OnlyFans, you are required to report it on your taxes. Whether you’re a full-time content creator or just making a few extra bucks on the side, the IRS expects you to report your income. But don’t worry, we’ll break it down for you and explain everything you need to know about paying taxes on OnlyFans. So, let’s dive into the world of taxes and OnlyFans together!

Do You Pay Taxes on OnlyFans?

In recent years, OnlyFans has gained significant popularity as a platform for content creators to monetize their work. With its subscription-based model, creators can earn income by providing exclusive content to their subscribers. However, as with any form of income, the question arises: do you need to pay taxes on your earnings from OnlyFans? In this article, we will explore the tax obligations that come with being an OnlyFans creator and provide you with important information to help you navigate the tax landscape.

Tax Obligations for OnlyFans Creators

As an OnlyFans creator, you are considered self-employed, and your earnings from the platform are taxable income. This means that you are responsible for reporting your earnings and paying taxes on them. Whether you are a full-time content creator or only earn a side income from OnlyFans, it is essential to understand your tax obligations to avoid any legal issues in the future.

When it comes to paying taxes on your OnlyFans earnings, there are a few key considerations:

1. Self-Employment Taxes

As a self-employed individual, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This is known as self-employment tax. The current self-employment tax rate is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. These taxes are in addition to your regular income tax.

It’s important to note that self-employment taxes are typically paid quarterly, so you will need to estimate your income and make timely payments throughout the year to avoid penalties and interest.

2. Income Tax

In addition to self-employment taxes, you are also required to pay income tax on your OnlyFans earnings. The amount of income tax you owe will depend on your total income, deductions, and any applicable tax credits. It’s crucial to keep accurate records of your earnings and expenses to properly calculate your taxable income.

Depending on your country of residence, you may also be subject to state or provincial income taxes, as well as any applicable local taxes. It’s essential to familiarize yourself with the tax laws in your jurisdiction to ensure compliance.

Keeping Track of Your Earnings and Expenses

To fulfill your tax obligations as an OnlyFans creator, it’s crucial to keep detailed records of your earnings and expenses. This includes tracking your subscription revenue, tips, merchandise sales, and any other sources of income from the platform.

Additionally, you should keep records of your business expenses, such as equipment purchases, internet fees, advertising costs, and any fees or commissions paid to OnlyFans. These expenses can be deducted from your total income, potentially reducing your taxable income and lowering your tax liability.

Using accounting software or hiring a professional accountant can help streamline this process and ensure accurate record-keeping. By maintaining organized financial records, you can easily calculate your taxable income, claim deductions, and meet your tax obligations.

Seeking Professional Advice

While this article provides a general overview of the tax obligations for OnlyFans creators, it’s important to note that tax laws can vary depending on your jurisdiction. To ensure compliance and make the most of potential deductions, it’s advisable to consult with a tax professional who specializes in self-employment taxes or online content creation.

A tax professional can help you navigate the complexities of the tax system, provide personalized advice based on your specific circumstances, and ensure that you are maximizing your deductions while staying within the bounds of the law.

Conclusion

As an OnlyFans creator, it’s crucial to understand your tax obligations and stay on top of your financial responsibilities. By paying self-employment and income taxes, keeping accurate records of your earnings and expenses, and seeking professional advice when needed, you can ensure that you are in compliance with tax laws and avoid any potential issues in the future.

Key Takeaways: Do You Pay Taxes on Only Fans?

- 1. OnlyFans creators are responsible for paying taxes on their earnings.

- 2. Income from OnlyFans should be reported as self-employment income.

- 3. Keep track of your earnings and expenses for tax purposes.

- 4. Consult with a tax professional to understand your specific tax obligations.

- 5. Paying taxes on OnlyFans is important to avoid legal issues and penalties.

Frequently Asked Questions

Here are some common questions people have about paying taxes on OnlyFans:

1. Are OnlyFans earnings taxable?

Yes, the earnings you make on OnlyFans are taxable. Whether you earn money through subscriptions, tips, or any other form of income on the platform, it is considered taxable income by the tax authorities. You are required to report and pay taxes on your OnlyFans earnings.

It’s important to keep track of your earnings and expenses related to your OnlyFans business. This will help you accurately report your income and deduct any eligible business expenses when filing your taxes.

2. How do I report my OnlyFans earnings?

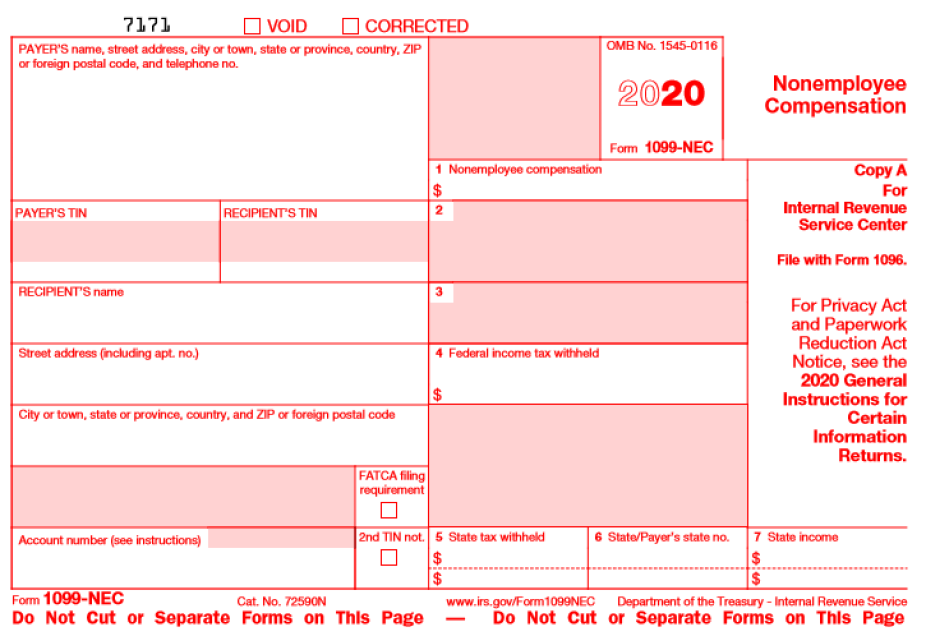

In most countries, you will report your OnlyFans earnings as self-employment income. This means you will need to fill out the appropriate tax forms for self-employed individuals, such as a Schedule C in the United States. It’s recommended to consult with a tax professional or use tax software to ensure you correctly report your OnlyFans earnings.

Remember to keep detailed records of your earnings and any related expenses, such as equipment costs, marketing expenses, and platform fees. These records will be crucial when reporting your income and claiming deductions.

3. Do I need to pay estimated taxes on my OnlyFans earnings?

If you expect to owe $1,000 or more in taxes from your OnlyFans earnings, you may need to pay estimated taxes throughout the year. Estimated taxes are quarterly tax payments made to the tax authorities to cover your tax liability. Failure to pay estimated taxes when required may result in penalties and interest.

It’s advisable to consult with a tax professional or use tax software to calculate and make your estimated tax payments. They can help you determine the appropriate amount to pay and ensure you stay compliant with tax regulations.

4. Can I deduct expenses related to my OnlyFans business?

Yes, you can deduct legitimate business expenses related to your OnlyFans business. This includes expenses such as equipment, internet fees, advertising costs, and professional fees. However, it’s important to ensure these expenses are directly related to your business and are necessary for its operation.

Keep detailed records and receipts of your business expenses to support your deductions. Consult with a tax professional to understand which expenses are eligible for deduction and how to properly document them.

5. What happens if I don’t pay taxes on my OnlyFans earnings?

Failing to pay taxes on your OnlyFans earnings can have serious consequences. Tax authorities have the power to impose fines, penalties, and even pursue legal action against individuals who evade taxes. Additionally, unpaid taxes can accumulate interest over time, further increasing your financial burden.

It’s essential to fulfill your tax obligations by reporting and paying taxes on your OnlyFans earnings. If you’re unsure about how to handle your taxes, seek guidance from a tax professional who can assist you in navigating the tax requirements specific to your situation.

How I File My ONLYFANS TAXES!

Final Thoughts: Do You Pay Taxes on Only Fans?

So, after diving into the world of Only Fans and taxes, we’ve come to the conclusion that it’s important to be aware of your tax obligations as an Only Fans creator. While the platform itself doesn’t withhold taxes for you, that doesn’t mean you’re off the hook. The income you earn from Only Fans is considered self-employment income, which means you’re responsible for reporting it and paying taxes on it.

Now, before you start panicking, remember that paying taxes is just a part of being a responsible citizen. Plus, there are some benefits to being your own boss. As a self-employed individual, you have the opportunity to deduct certain business expenses, such as equipment, internet costs, and even a portion of your home if it’s used as your workspace. These deductions can help offset some of the tax liability and reduce your overall tax burden.

However, it’s crucial to keep detailed records of your earnings and expenses to accurately report them on your tax return. Consider consulting with a tax professional who can guide you through the process and ensure you’re taking advantage of all the deductions available to you. Remember, staying on top of your tax obligations will not only keep you out of trouble with the IRS but also help you build a solid financial foundation for your Only Fans career.

In conclusion, while Only Fans may provide a lucrative income stream, it’s essential to understand and fulfill your tax obligations as a self-employed individual. By staying organized, keeping accurate records, and seeking professional guidance when needed, you can navigate the world of taxes with confidence and ensure that you’re not only creating engaging content but also managing your finances responsibly. So, go ahead and continue pursuing your passion on Only Fans, but don’t forget to pay your taxes along the way. Stay informed, stay organized, and enjoy the rewards of your hard work!