If you’re a content creator on OnlyFans, you may be wondering how to navigate the world of taxes. Filing taxes for OnlyFans can be a bit confusing, but fear not! In this article, we’ll break down the process and provide you with some helpful tips to ensure you stay on top of your tax obligations. So, grab a cup of coffee, sit back, and let’s dive into the world of filing taxes for OnlyFans.

When it comes to filing taxes for OnlyFans, it’s important to understand that you are considered self-employed. This means that you are responsible for reporting and paying taxes on your earnings. Now, don’t panic! We’ll guide you through the process step by step, making it as painless as possible. From keeping track of your income to understanding deductible expenses, we’ll cover everything you need to know to stay in the good graces of the taxman. So, let’s get started and ensure that your OnlyFans journey remains both profitable and tax-compliant.

How to File Taxes for OnlyFans?

Step 1: Gather your financial records, including income statements and expense receipts.

Step 2: Determine your business structure. OnlyFans creators are typically considered self-employed.

Step 3: Calculate your total income from OnlyFans, including tips and subscriptions.

Step 4: Deduct eligible business expenses, such as camera equipment or internet costs.

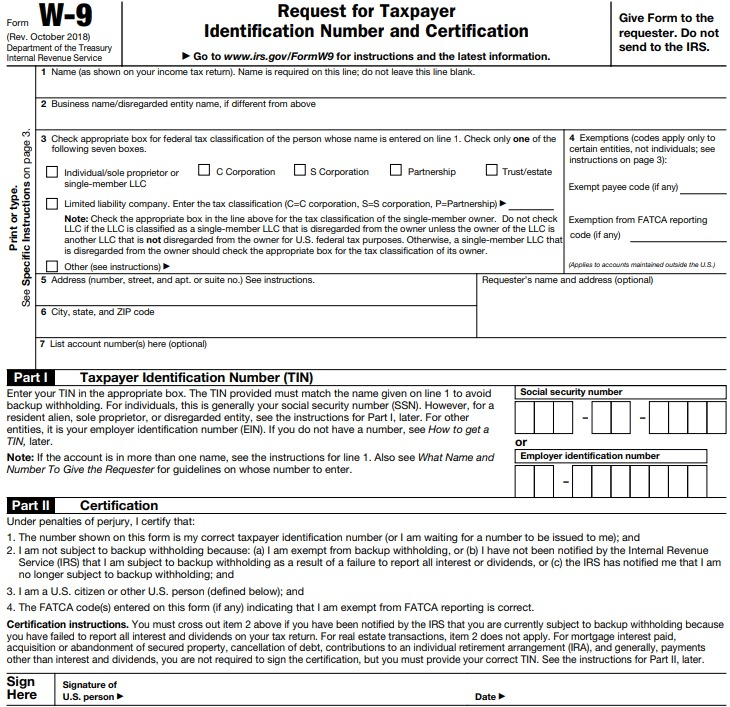

Step 5: Complete the necessary tax forms, such as Schedule C, to report your self-employment income and expenses.

Step 6: File your tax return by the deadline, usually April 15th.

Step 7: Consider consulting a tax professional for guidance and to ensure accuracy.

How to File Taxes for Only Fans?

Filing taxes can be a daunting task for anyone, and when it comes to income earned from platforms like OnlyFans, it can add an extra layer of complexity. As a content creator on OnlyFans, it’s important to understand your tax obligations and ensure that you are reporting your earnings accurately. In this article, we will guide you through the process of filing taxes for OnlyFans, providing you with valuable information to navigate this aspect of your business.

Understanding Your Tax Obligations

When it comes to filing taxes for OnlyFans, it’s crucial to understand your tax obligations as a self-employed individual. As an OnlyFans content creator, you are considered self-employed and are responsible for reporting your earnings and paying taxes on them. The income you earn from OnlyFans is considered self-employment income, which means you will need to file a Schedule C along with your regular tax return.

When filing taxes as a self-employed individual, you are responsible for both the employer and employee portion of Social Security and Medicare taxes, also known as self-employment taxes. This means that you will need to pay a higher percentage of your income towards these taxes compared to being an employee. It’s important to keep this in mind when budgeting for your tax payments throughout the year.

Gather Your Income and Expense Information

Before you begin the process of filing your taxes for OnlyFans, it’s important to gather all the necessary income and expense information. This includes documenting your earnings from OnlyFans, as well as any related expenses that can be deducted from your income. Keeping detailed records of your income and expenses throughout the year will make the tax filing process much smoother.

To gather your income information, you can refer to your OnlyFans account statements. OnlyFans provides monthly statements that outline your earnings for each month. Make sure to carefully review these statements to ensure accuracy. Additionally, if you receive any tips or gifts from your subscribers, make sure to include those as part of your income as well.

In terms of expenses, there are several deductions that you may be eligible for as an OnlyFans content creator. These can include things like camera equipment, props, costumes, internet expenses, and even a portion of your rent or mortgage if you use a dedicated space for your content creation. Keep track of these expenses throughout the year so that you can deduct them when filing your taxes.

Calculate Your Self-Employment Taxes

As mentioned earlier, as a self-employed individual, you are responsible for paying both the employer and employee portion of Social Security and Medicare taxes. These taxes are calculated based on your net self-employment income, which is your total income from OnlyFans minus any allowable deductions.

To calculate your self-employment taxes, you can use Schedule SE, which is a separate form that accompanies your regular tax return. Schedule SE will help you determine the amount of self-employment taxes you owe based on your net self-employment income. It’s important to accurately calculate and pay these taxes to avoid any penalties or interest charges from the IRS.

Reporting Your Income and Deductions

When it comes to reporting your income and deductions for OnlyFans, you will need to file a Schedule C along with your regular tax return. Schedule C is the form used to report self-employment income and expenses. It allows you to deduct eligible expenses from your income, resulting in your net self-employment income.

On Schedule C, you will need to provide detailed information about your income from OnlyFans, including any tips or gifts received. Additionally, you will list your eligible expenses and calculate your net self-employment income. It’s important to accurately report your income and deductions to ensure compliance with tax laws.

Seek Professional Guidance

While this article provides a general overview of how to file taxes for OnlyFans, it’s important to note that tax laws can be complex and subject to change. It’s always a good idea to seek professional guidance from a tax accountant or tax attorney who specializes in self-employment taxes. They can provide personalized advice based on your specific situation and ensure that you are maximizing your deductions while staying compliant with tax regulations.

In conclusion, filing taxes for OnlyFans requires careful consideration of your tax obligations as a self-employed individual. Understanding your income and expenses, calculating your self-employment taxes, and accurately reporting your income and deductions are crucial steps in the process. By following these guidelines and seeking professional guidance when needed, you can ensure that you are fulfilling your tax obligations while optimizing your tax situation as an OnlyFans content creator.

Key Takeaways: How to File Taxes for Only Fans?

- Filing taxes for Only Fans income is important to stay compliant with tax laws.

- Keep track of your earnings and expenses related to your Only Fans business.

- Consult with a tax professional who understands the unique aspects of the adult content industry.

- Understand the tax deductions you may be eligible for, such as expenses for costumes, props, and equipment.

- File your taxes accurately and on time to avoid penalties and interest.

Frequently Asked Questions

Can I file taxes for my OnlyFans income?

Yes, if you earn income from OnlyFans, you are required to report it on your tax return. The IRS considers income from all sources, including online platforms like OnlyFans, as taxable. It is important to keep track of your earnings and any associated expenses throughout the year to accurately report your income.

When filing your taxes, you will need to report your OnlyFans income on Schedule C, which is used to report income or loss from a business. You will also need to pay self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes.

What expenses can I deduct when filing taxes for OnlyFans?

As an OnlyFans creator, you can deduct certain expenses related to your business. These deductions can help reduce your taxable income and lower your overall tax liability. Some common deductible expenses for OnlyFans creators include:

1. Equipment and supplies: You can deduct the cost of cameras, lighting equipment, props, costumes, and other necessary supplies for creating content.

2. Internet and phone expenses: If you use the internet and your phone for business purposes, you can deduct a portion of these expenses.

3. Home office expenses: If you have a dedicated space in your home that you use exclusively for your OnlyFans business, you may be able to deduct a portion of your rent or mortgage, utilities, and other home-related expenses.

It’s important to keep detailed records of your expenses and consult with a tax professional to ensure you are taking advantage of all eligible deductions.

Do I need to pay estimated taxes for my OnlyFans income?

If you expect to owe at least $1,000 in taxes from your OnlyFans income, you may be required to make estimated tax payments throughout the year. Estimated tax payments are quarterly payments made to the IRS to cover your tax liability.

To determine if you need to make estimated tax payments, you can use Form 1040-ES, which includes a worksheet to calculate your estimated tax liability. If you are unsure about how much to pay or whether you need to make estimated tax payments, it is recommended to consult with a tax professional.

What should I do if I haven’t been filing taxes for my OnlyFans income?

If you have been earning income from OnlyFans but have not been filing taxes, it’s important to take steps to rectify the situation. Failing to report your income can result in penalties and interest charges from the IRS.

The first step is to gather all necessary documentation, including your earnings from OnlyFans and any associated expenses. You may need to file back tax returns for previous years if you have not been filing. It is highly recommended to consult with a tax professional who can guide you through the process and help you become compliant with your tax obligations.

Can I get in trouble with the IRS for my OnlyFans income?

Yes, failing to report your OnlyFans income to the IRS can result in serious consequences. The IRS has been cracking down on unreported income, and penalties for non-compliance can include fines, interest charges, and even criminal prosecution in extreme cases.

To avoid getting in trouble with the IRS, it is important to accurately report your OnlyFans income and comply with all tax obligations. Working with a tax professional can help ensure you are meeting all requirements and staying in good standing with the IRS.

How I File My ONLYFANS TAXES!

Final Summary: Navigating Tax Filing for OnlyFans

So, there you have it! We’ve covered the ins and outs of filing taxes for OnlyFans and ensuring you stay on the right side of the law while maximizing your earnings. It’s important to remember that although this may seem like unfamiliar territory, with the right information and guidance, you can confidently navigate the world of tax filing as an OnlyFans creator.

First and foremost, documenting your income and expenses is crucial. Keep track of all your earnings from your OnlyFans account, as well as any related expenses such as equipment, props, or marketing expenses. This will not only help you accurately report your income but also provide deductions that can lower your tax liability.

Furthermore, consulting with a tax professional or accountant who specializes in self-employment and the adult entertainment industry can be a game-changer. They can guide you through the complexities of tax laws, help you identify eligible deductions, and ensure you’re in compliance with all the necessary regulations. Remember, investing in expert advice is an investment in your financial peace of mind.

In conclusion, while the world of tax filing may seem daunting, it doesn’t have to be. With the right knowledge, organization, and professional guidance, you can confidently file your taxes as an OnlyFans creator. By taking the time to understand the unique tax considerations and diligently keeping track of your income and expenses, you’ll not only fulfill your legal obligations but also optimize your financial situation. So, put your worries aside and focus on what you do best – creating amazing content for your fans. Happy filing!